Condo Insurance in and around Franklin

Condo unitowners of Franklin, State Farm has you covered.

Cover your home, wisely

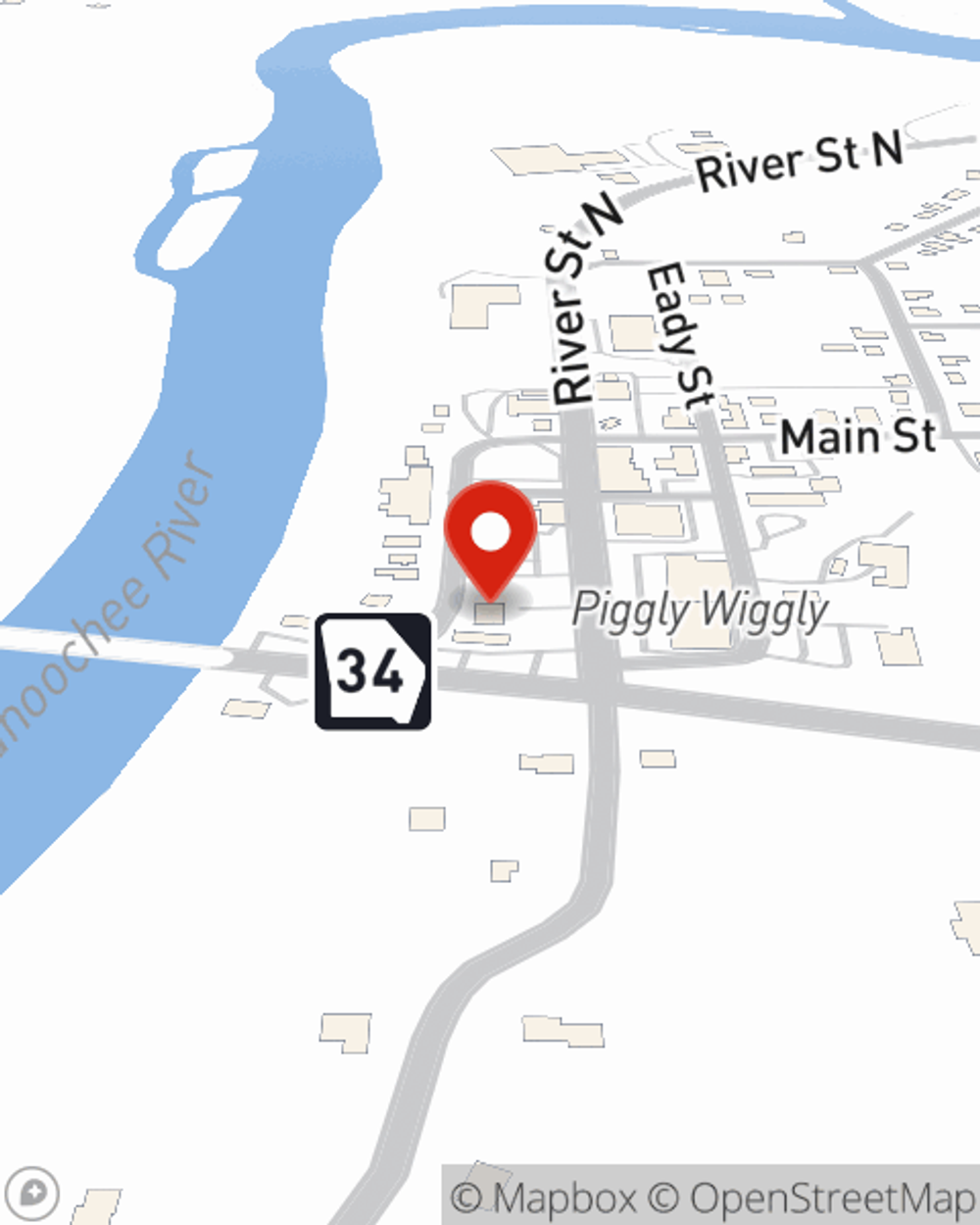

- Franklin, GA

- Lagrange, GA

- Hogansville, GA

- Grantville, GA

- Newnan, GA

- Roopville, GA

- Heard County

- Carroll County

- Coweta County

- Troup County

- West Point

- West Point Lake

- Centralhatchee

- Ephesus

- Whitesburg, GA

- Villa Rica

- Peachtree City

- Sharpsburg

- Bowdon

- Palmetto

- Hillcrest

- Pine Mountain

There’s No Place Like Home

There are plenty of choices for condo unitowners insurance in Franklin. Sorting through providers and savings options is a lot to deal with. But if you want surprisingly great priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Franklin enjoy impressive value and hassle-free service by working with State Farm Agent Terry Harper. That’s because Terry Harper can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as pictures, home gadgets, furnishings, videogame systems, and more!

Condo unitowners of Franklin, State Farm has you covered.

Cover your home, wisely

Agent Terry Harper, At Your Service

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo from theft, fire or a tornado.

As a dependable provider of condo unitowners insurance in Franklin, GA, State Farm helps you keep your belongings protected. Call State Farm agent Terry Harper today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Terry at (706) 675-3093 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Terry Harper

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.